Let’s lend a hand to those who serve us.

Salt Lake City food & beverage workers displaced by the Coronavirus pandemic and SLC earthquake need your help.

Last month, there were 15,000 people working in Salt Lake City restaurants and bars--neighborhood joints, fast food, fine dining--all gathering places in our community. This week, thousands of them don’t have an income and don’t know when they can go back to work.

They are on the front lines of the economic crisis caused by the Coronavirus pandemic. The earthquake in Salt Lake City on March 18 was yet another blow. Some establishments don’t know when they can reopen due to structural damage in their buildings.

Thank you for making a gift below. Every dollar donated will go directly to SLC hospitality workers.

If you would like to make a gift over $1,000 please contact and we will make direct arrangements so your full gift goes to the hospitality workers in need with no processing fees.

Many Thanks,

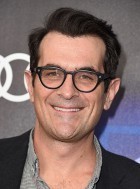

Ty Burrell

Ty Burrell Mayor Erin Mendenhall

Mayor Erin Mendenhall

Fund Distribution Update:

We have been gratified to hear back from recipients that Tip Your Server grants have sustained them at this difficult time. We are heartened by the tremendous generosity in our community. Fundraising continues as displaced workers’ needs are great. We are disbursing the funds fairly and responsibly and making every effort to disburse funds as quickly as possible.

One hundred percent of the funds raised will be paid directly to service workers from bars and restaurants in Salt Lake City. We pay out grants within 2 business days after receiving the displaced workers’ complete payment information (see process below). Any delay in disbursing payment results from the lag in getting accurate payment information from restaurants and individuals.

If you have questions or concerns, please contact us at

Fund Distribution FAQ

Q: How does selection work?

A: Recognizing that there are more restaurants and more servers than we can fund, we pulled a list of all eligible establishments licensed with approved NAICS codes. 560 restaurants and bars licensed in SLC were compiled and then randomized. Owners from randomly selected restaurants will be contacted in rounds by the Utah Restaurant Association, with the first round consisting of 40 establishments. Once contacted, those owners may submit up to five displaced workers to receive a $500 grant. Owners may select the workers based on their own criteria, whether those individuals with the greatest need, a random selection, or otherwise.

Once the employer has filled out the form, the employees will be contacted directly by the Downtown Alliance with a request to submit a W-9 in a specified period of time. Payment will be sent directly to the employee within two business days.

Additional notification rounds will commence as long as funds are made available through the Tip Your Server program.

Workers that have applied for unemployment are eligible for this grant. However, workers who have not been displaced or currently have income in an establishment should not be included.

Q: Why was this method selected?

A: Our guiding principles were fairness, fast deployment and making a meaningful grant to the selected workers.

This method was developed with input from restaurant advisors in order to ensure the most equitable and expedient process possible and to provide a meaningful sum of assistance to workers. This method minimizes the administrative burden on workers and restaurant owners. Only the randomly selected restaurants and the selected workers are asked to complete the application process instead of asking all restaurants or all workers to provide information.

Q: What employees are eligible to receive the Tip Your Server grant?

A: Eligible employees include Salt Lake City restaurant and bar employees who have lost their primary income since March 16, 2020, due to business closures or restricted operations resulting from the COVID-19 pandemic and/or the March 18 earthquake. Intended recipients are those who relied on tips for most of their income. They face a larger burden in establishing eligibility for unemployment insurance, but. Employees working in front- or back-of-house roles are not excluded and may be selected by the restaurant owner.

Q: I’m a business and I’m concerned that I am only able to submit five employees. Can I expand that pool?

A: The number of payments we can provide is limited by the funds we raise. At this stage, we are limiting eligibility to five employees per establishment in order to reach as many teams as possible rather than paying out to a few large teams. As additional funds are available, we will expand the reach.

We recognize the difficulty this presents for a business owner. Or anyone who is allocating resources that do not cover all of the needs in the community. We believe business owners are closest to the needs of their teams and can make the best selections. Or, an owner can select the five team members randomly.

Q: Will this grant affect unemployment insurance or 2020 tax filing?

A: According to the DWS Unemployment Insurance Claimant Guide found at https://jobs.utah.gov/ui/jobseeker/claimguide.html, under sections “Work and Earnings Reporting” and “Vacation, Holiday, Severance or Separation Pay”, this income will not have an impact on eligibility to collect Unemployment Insurance. Recipients will not need to report this grant in tax filings unless disbursed funds exceed $600 per individual based on additional fundraising efforts.

Q: I need help with translation services to process my claim. Is this service available?

A: We haven’t identified a single point of translation service. However, we will assist individuals and businesses that request translation assistance in the process. Deadlines may be adjusted to accommodate for translation services. This section will be updated as translation services are clarified.

Q: How is this fund organized?

A: The fund was established by Ty Burrell, Salt Lake City Corporation, and Downtown Alliance. Utah Restaurant Association is assisting with restaurant communications. As of March 28, more than a thousand other individuals and organizations have contributed to the fund. 100% of donated funds shall be granted to displaced servers working in Salt Lake City restaurants.

MISC FAQ

Q: How can my foundation or company support this fund?

A: Contact and we will follow up. Thank you!

Q: Is the gift tax-deductible?

A: Yes. Contributions and disbursements will be through SLC Downtown Presents, a 501c3 non-profit organization.

Q: What businesses can request support for their workers?

A: At this time, only workers submitted by randomly selected Salt Lake City restaurant or bar employers are eligible. We are hopeful that with broad financial support from other businesses and individuals that we can expand the support to food & beverage workers at additional venues.

Q: Are there other resources for food & beverage employees and businesses at risk?

A: SBA Disaster Loan Assistance: sba.gov/disaster

Salt Lake City Emergency Loan Program: slc.gov/ed/elploan

State of Utah Unemployment Insurance: jobs.utah.gov/ui